Quick automobiles, fancy watches, and hundreds of thousands lacking—the rise and fast fall of Zadeh Kicks is a cautionary story a couple of white-hot enterprise that strikes so quick it outpaces each regulators and client safety.

To make sense of the story of Zadeh Kicks, now we have to first perceive just a few different issues: how a enterprise can function in a shadow area with out direct ties to suppliers of its merchandise; the risks of non-traditional and high-interest loans; why the sneaker resale enterprise has change into the most popular area in males’s vogue; and the platforms that hosted the enterprise and processed the cash, and have become accomplices in its drastic downfall.

THE BACKSTORY OF ZADEH KICKS

Final month, the world of sneaker resale was shaken by the information that Eugene, Oregon based mostly Zadeh Kicks had requested an Oregon court docket to dissolve its nine-year-old enterprise, declaring itself bancrupt and unable to pay hundreds of thousands of {dollars} price of debt.

Days after the submitting, zadehkicks.com modified its homepage, directing clients to contact David P. Stapleton, the court-appointed receiver. Inside hours, hundreds of Zadeh Kicks clients had joined a reside Twitter area, on the lookout for solutions on how one can recuperate their cash, and to share their experiences with Michael Malekzadeh, the corporate’s proprietor.

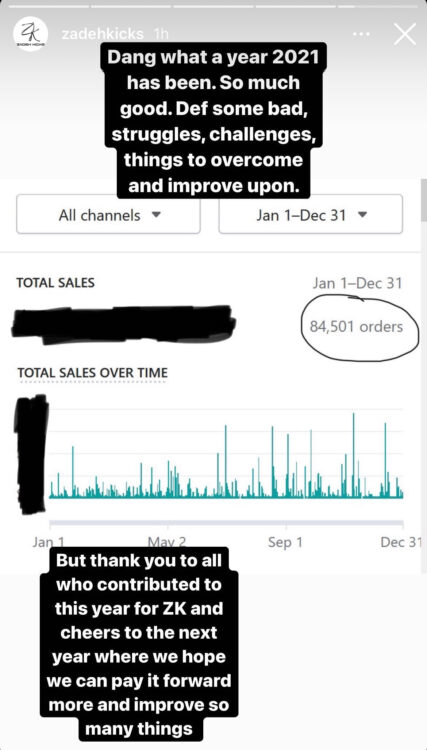

Malekzadeh launched Zadeh Kicks, LLC in 2013 and noticed it develop quickly, climbing to $2M in gross sales by 2015, $6M in month-to-month gross sales in 2017, and ultimately rating within the prime 1% of all Shopify Retailers by 2020. In 2021, they recorded over 84,500 gross sales with estimates of pre-orders to be price greater than $100,000,000.

Zadeh Kicks bought extremely sought-after, limited-edition sneakers from the likes of Jordan, Nike, and Yeezy, however had no direct relationship with these manufacturers—or any others. To acquire the footwear—as described on zadehkicks.com earlier than the location was taken offline—Zadeh Kicks would buy the merchandise from unbiased retailers and suppliers.

Previous to forming Zadeh Kicks, Michael Malekzadeh bought older inventory from retail shops and bought them on ebay. By growing relationships with the shops he bought from, Malekzadeh was ultimately capable of safe newly launched merchandise, together with retro Jordans, in a way generally referred to within the enterprise as a “backdoor” association.

He instructed me each one in every of my mates in retail was promoting to him, however I by no means did

Proprietor of Licensed Nike retailer recalling encounter with Michael Malekzadeh

Nike, like many footwear manufacturers, rigorously restricts the merchandise they can order and which accounts are approved to promote these merchandise on-line. Brick and mortar shops that are prohibited from promoting on-line, although, will typically depend on a handful of people to deal with footwear in leftover sizes, and to scrub older merchandise out of the inventory room and off the steadiness sheet. The service that Zadeh supplied has been widespread apply within the sneaker enterprise for years, however has at all times operated within the shadows of main manufacturers, as this methodology of offloading older inventory to marketplaces like ebay or Amazon is technically a violation of retailer agreements.

A BOOM FOR ZADEH

Zadeh Kicks’ petition for dissolution makes it clear that, starting in January of 2020, the enterprise skilled “exponential development” from pre-sales of yet-to-be-released sneakers, however was unable to maintain up with that development, missing enough programs to deal with the surge in enterprise.

By September of 2020, zadehkicks.com achieved the milestone of rating within the prime 1% of Shopify shops. The @zadehkicks Instagram web page has a replica of the e-mail from Shopify pinned regardless of having deleted 3,432 Instagram posts since February of 2022 and just lately made the account non-public.

The expansion continued in 2021 as Zadeh Kicks recorded greater than 84,500 orders. A screenshot of this achievement was additionally posted as a narrative replace on the @zadehkicks Instagram.

A BOOM FOR RESALE SNEAKER BUSINESS

The COVID-19 pandemic and ensuing closures of retail shops triggered a large adjustment within the sneaker business. With little time to plan, manufacturers and retailers needed to scramble to engineer new methods to promote their footwear, regardless of being shuttered in a lot of the nation. Nike, for instance, permitted beforehand unauthorized retailers to start out promoting on-line. Giant chain shops reminiscent of Foot Locker responded by allocating extra models to their e-commerce platform as lots of of malls shut down.

Shortly into the pandemic, the Netflix docuseries The Final Dance aired over the course of 5 weeks, telling the story of Michael Jordan’s historic closing season with the Chicago Bulls. The success of the sequence was mirrored not simply in streaming quantity, however in an elevated demand for retro Air Jordans, driving up costs.

The Air Jordan 1 “Chicago” 2015 Retro, as an example, bought for a mean value of $938 in March of 2020; by Might, after the final episode of The Final Dance aired, they have been promoting for a mean of $1517.

One other issue pushing up sneaker costs was the federal authorities’s determination to answer the pandemic by issuing financial stimulus checks.

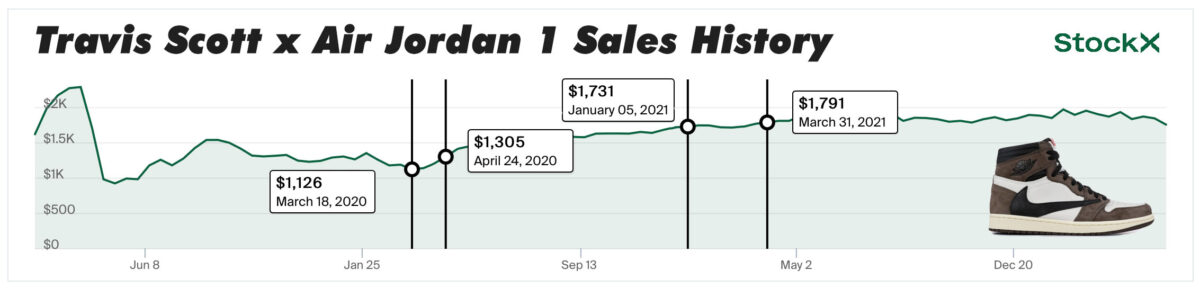

The Travis Scott x Air Jordan 1, launched in Might of 2019, noticed its value peak for the yr that summer time, and was on a downward pattern—till the primary stimulus checks began arriving in March of 2020.

“You might watch the Travis Scott Jordan 1 gross sales soar with every stimulus test,” Ralph Gandara of Sneaker Summit instructed Good Kicks in 2021. “Hastily, folks bought $1400 within the mail and the Travis Scotts have been proper beneath that, so for lots of parents they opened an envelope and had a ticket for one in every of their grails.”

SNEAKERS AS AN INVESTMENT CLASS

On stage in 2015, StockX co-founder and former CEO Josh Luber talked in regards to the market mechanics of sneakers, and alluded to the potential for a “Inventory Market of Issues.” StockX, backed by serial entrepreneur Dan Gilbert, launched in February of 2016, providing customers the power to put bids and asks for sneakers, much like how a inventory dealer would. It additionally reported market information on product pages, offering fast perception into their value historical past.

In 2019, Cowen Research launched a report declaring sneakers to be an “different asset class”, projecting the sneaker resale market to achieve $30 billion by 2030. In a follow-up report launched in 2021, Cowen reported that the sneaker resale market grew 100% in 2020, with the business passing $2 billion in US gross sales, and anticipated 20% year-over-year development for the remainder of the last decade. Extra just lately, the group launched its third report within the Sneakers as an Funding Class sequence, sustaining their 2030 projection, and including that sneaker resale was considerably outperforming the broader e-commerce ecosystem, which had been decelerating into early 2022.

Along with conventional sneaker resale funding alternatives, there’s been a dramatic rise in curiosity in one-of-a-kind and game-worn sneakers. Public sale homes Soetheby’s, Christies, and Heritage Auctions have hosted gross sales for footwear worn by Michael Jordan, Scottie Pippen, Allen Iverson, and different NBA Corridor of Famers. Christie’s teamed up with sneaker resale retailer Stadium Goods to curate a group of 11 pairs of game-worn Michael Jordan footwear, which bought for a complete of $931,875.

The costliest sneaker sale in historical past befell in April of 2021, when Sotheby’s facilitated the non-public sale of a Nike Air Yeezy prototype worn by Kanye West throughout the 2008 Grammy Awards, for $1.8 Million. The purchaser was RARES, an organization that permits retail traders to buy fractional shares of footwear, for as little as $5.

SNEAKER FUTURES

Nike sells footwear to their approved retailers primarily by two forms of transactions:

- directly (additionally referred to as available-to-ship) orders are merchandise at the moment in inventory

- futures orders booked by the retailer 5 to 6 months earlier than launch

For each order varieties, it’s commonplace apply for retailers to pay for his or her orders after the product leaves the model’s warehouse – usually 60 days afterward.

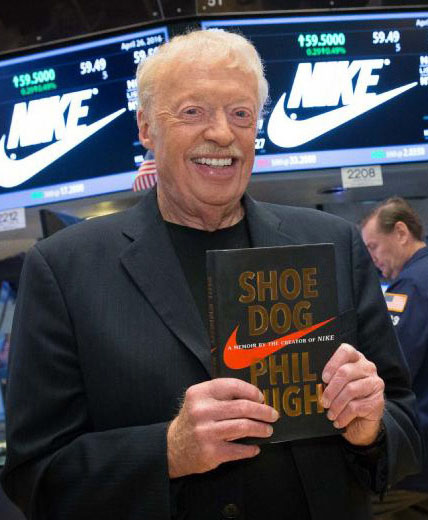

Nike’s co-founder and former CEO Phil Knight mentioned in his just lately launched memoir Shoe Canine in regards to the origin of futures. Nike administration primarily made up the idea of future orders because it applies to its enterprise as a cash-generating software for when instances have been nonetheless lean throughout their early development days.

In Zadeh Kicks’ pre-order enterprise mannequin, although, orders have been positioned and paid for upfront by clients. The window of time between buyer prepayment and product supply diversified, usually between three and 6 months forward of launch.

“In hindsight and issues now, when Zadeh was providing pre-orders for footwear, he primarily bought us an choices contract or commodity future, however with not precisely probably the most definitive supply date set in stone,” a Zadeh Kicks purchaser since 2019 said. “To make it worse, among the footwear he took orders for he couldn’t have probably verified that he would have entry to as a result of they didn’t exist.”

Among the footwear he [Michael Malekzadeh] took orders for he couldn’t have probably verified that he would have entry to—they merely didn’t exist.

Bulk pre-order buyer of Zadeh Kicks since 2019

Quite a few instances Zadeh Kicks bought footwear based mostly solely on a Photoshop mockup of a colorway that by no means got here to market.

Since Zadeh Kicks relied on retail shops to provide them by backdoor preparations, clients by no means anticipated to get their footwear forward of the official launch date, however usually obtained them not too lengthy afterwards. This was usually not seen as an issue for patrons who positioned bulk pre-orders, as costs tended to start out rising shortly after the product was launched.

Some pre-orders arrived rapidly, although it trusted a number of components. “It wasn’t simply at first that I obtained my gadgets rapidly or after I had smaller orders, nevertheless it was additionally when my pre-order value that I paid was nicely above the market value when the footwear got here out,” stated an everyday Zadeh Kicks buyer since 2020 who’s owed over $25,000.

However then issues started to alter. “Often it will take a month to get an order in, however beginning in the summertime of 2020 a few of my orders took two or three months.” a bulk pre-order buyer since 2019 who shared with Good Kicks that he’s out greater than $3 Million in unfulfilled orders.

“It wasn’t out of the peculiar for the shipments to take a very long time to reach, and virtually by no means did all of them come collectively,” a pre-order buyer since 2020 instructed us. “I positioned an order for 200 pairs of Hearth Crimson Air Jordan 4s and I might get shipments of 16-20 pairs at a time. Usually a month or two between every cargo.”

All through 2020, transport delays bought progressively worse. “By the tip of the yr [2020], I didn’t thoughts if Zadeh supplied to purchase me out of my order somewhat than ready for the footwear to come back in. There was no telling how lengthy it will take, and I might have most well-liked to get the cash to buy extra pre-orders.”

A sample to Zadeh’s “buyouts” started to emerge. “Proper earlier than the discharge—normally only a couple days—he would let me know that he had a bulk purchaser lined up and actually pushed for me to do the deal. On the time, I believed that he made my life simpler with out having to deal with a big cargo of footwear that I wanted to seek out patrons for and if he was capable of make slightly cash off of my order, it will profit him too.”

Whether or not or not Malekzadeh truly had a bulk purchaser lined up is unknown. In hindsight, patrons we spoke with seemed again on these moments as Malekzadeh making an attempt to cowl his shortcomings in pre-ordered pairs, and keep away from the monetary ache of getting to buy on the secondary market to satisfy the orders he wasn’t capable of procure from his backdoor suppliers.

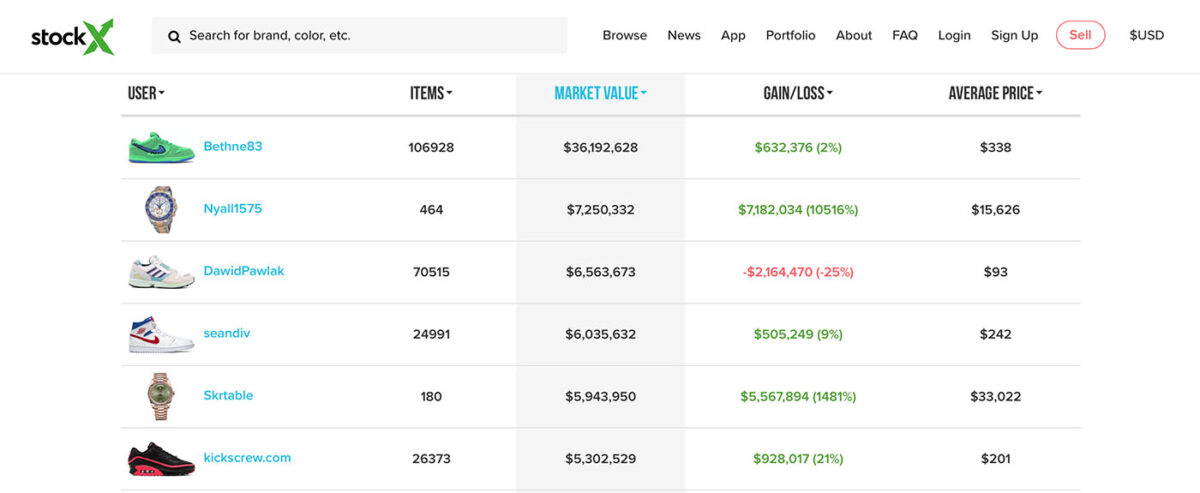

It was not a secret that Zadeh Kicks had an lively relationship with StockX as a buyer. A former worker of StockX reached out to Good Kicks to substantiate rumors that Zadeh Kicks was {the marketplace}’s largest purchaser, registered underneath the identical username (Bethne83) used on Instagram by Bethany Mockerman, Malekzadeh’s girlfriend. Mockerman additionally described herself on LinkedIn, at varied instances, as a Monetary Coordinator, Finance Supervisor, and CFO at Zadeh Kicks.

For just a few years, StockX publicly displayed the “portfolios” of StockX customers in the event that they granted permission. The portfolio would add any stock they selected to add, nevertheless it additionally routinely added gadgets bought by the StockX platform.

There was nothing significantly unsuitable with Zadeh Kicks utilizing StockX to buy footwear, however the giant quantity of purchases on the secondary market indicated what number of pre-orders Zadeh Kicks was filling this manner, somewhat than by buying from retailers or different suppliers.

THE BANK OF ZADEH

Zadeh’s supply to purchase out clients’ orders had existed for a number of years, however beginning in late 2020, an alternate methodology of switch turned obtainable: present playing cards. Fairly than sending cash by financial institution wire to repeat pre-order clients, the present playing cards allowed for cash to remain throughout the Zadeh Kicks checking account. For purchasers, utilizing present playing cards to put further orders was simpler than transferring money.

“Although the playing cards got here rapidly, it was a ache getting an extended checklist of those playing cards,” defined a Zadeh Kicks buyer since 2019. “The playing cards could be added to your account, however since they have been capped at $9,999, not solely would Zadeh need to manually create a bunch of the playing cards, we must apply them individually with every order.” Shopify’s Service Phrases cap the worth of present playing cards at $9,999.

Zadeh was not a fan of refunds of any variety both. Not solely have been patrons repeatedly threatened with being banned and blocked in the event that they requested for a refund, however the coverage web page on the Zadeh Kicks web site listed quite a few situations the place retailer credit score could be issued as a substitute of refunds…within the type of a present card. Shopify coverage, nonetheless, states that present playing cards might not be used rather than refunds to compensate customers for unshipped merchandise.

The present card system helped Zadeh Kicks maintain cash inside their system, and successfully delayed the purpose at which they needed to fulfill shoe orders or present payouts. “Finally, Zadeh created incentives to take buy-outs in present playing cards as a substitute of cash wire,” a buyer since 2018 shared with us. “In a single occasion, I used to be supplied $200 per pair if I did a cash wire or $210 by present card.”

However identical to the footwear, the cash transfers weren’t at all times quick. “He could be upfront about it, and clarify that he wanted just a few weeks to make the wire switch. Getting slightly greater than the wire and having it instantly meant it simply made extra sense to take the shop credit score to put extra pre-orders.”

In April of 2021, Zadeh Kicks began utilizing rise.ai, a third-party Shopify plugin, that supplied present playing cards with no limits. Fairly than utilizing present playing cards that have been a part of the native Shopify system, with a $9,999 restrict, bulk patrons may now have limitless worth present playing cards that functioned extra like funded accounts.

Due to the brand new playing cards that could possibly be loaded with any quantity, one may wire switch onerous funds to Zadeh Kicks and get a loaded credit score of their account to spend with out the bank card charges or inconvenience of dealing with 20-30 playing cards.

“Between us [other Zadeh buyers], we’d joke that we had a checking account steadiness and a ‘Z buck’ steadiness with a group of giant present playing cards typically valued at greater than $1 Million.”

There was a change of guidelines and not may we purchase in-stock gadgets with retailer credit—solely pre-orders. Then after some time, we couldn’t simply use retailer credit to ebook new pre-orders—we had so as to add cash too.

However ultimately, Zadeh Kicks put limitations on how “Z bucks” could possibly be spent. “I couldn’t keep in mind when it was precisely, however there was a change of guidelines, and not may we purchase in-stock gadgets with retailer credit—solely pre-orders. Then after some time, we couldn’t simply use retailer credit to ebook new pre-orders—we had so as to add cash too.”

A CYCLE OF LOANS AND DEBT

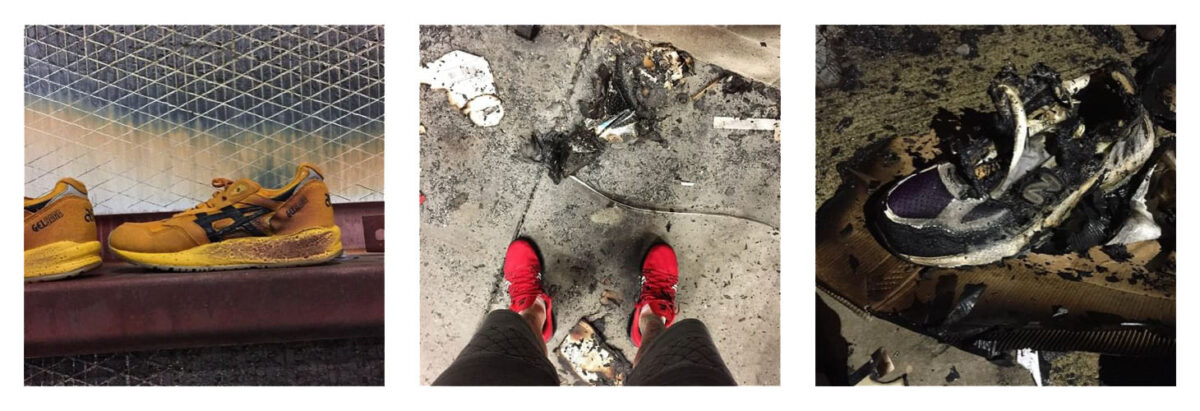

From the start, Zadeh Kicks confronted an uphill battle with loans and debt, simply as many new companies do. In October of 2014, solely a yr after it fashioned, a fireplace occurred within the Zadeh Kicks warehouse positioned at 710 Business Avenue in Eugene, Oregon. In accordance with Michael Malekzadeh’s recounting of the occasions to Sole Collector in 2015, the warehouse held greater than $400,000 price of merchandise on the time of the fireplace, which was allegedly began by a candle knocked over by a stray cat.

Malekzadeh discovered himself having to attend a number of months for his insurer Liberty Mutual to pay his declare. “Actually, I owed folks cash for product that I bought,” he stated, “and I used to be getting type of nervous on what I used to be going to do.”

Malekzadeh additionally spoke to forbes.com about money owed and loans for an article titled #SmallBizHowTo: How To Get Financing For Your Startup Or Small Enterprise, You Requested, We Answered. Within the piece, it was revealed that Malekzadeh had invested $30,000 of his personal cash into the enterprise he began in 2009, underneath the title Zadeh Ideas.

He additionally took out Service provider Money Advances, which offer capital upfront to companies, that are then repaid, plus charges, utilizing a share of the enterprise’s future gross sales. Such a mortgage is notorious for inflicting debt traps, the place retailers borrow to repay a previous mortgage, making a repeating cycle that places them deeper and deeper within the gap. In accordance with Malekzadeh’s recollection, that first mortgage grew to change into ten or twelve from a number of lenders, with cost phrases starting from three to 9 months. “The worst one I did, I’m fairly certain, was $75,000 at $110,000 payback. So long as I’m flipping my product ceaselessly, I’ll nonetheless earn a living, however I’ve to work my butt off to pay all that curiosity,” he instructed Forbes.

By October 2015, Zadeh Kicks had secured a listing line of credit score as much as $240,000 at an rate of interest of 18.99%, and a $70,000 time period mortgage for 12 months at an APR of twenty-two%—charges nearer to these of client bank cards—to get away from the Service provider Money Advance cycle. However regardless of these acquiring strains of credit score, it wasn’t lengthy earlier than Zadeh discovered himself going again to extra Service provider Money Advances.

In 2017, Zadeh began working with John Ponte of Ponte Investments, a supplier of service provider case advances based mostly in Warwick, Rhode Island. Ponte said that Zadeh was a very good consumer initially. “He checked out—within the [loan] enterprise now we have a database of companies which have inaccuracies with their financial institution statements and Zadeh was by no means a priority for us.” Ponte was additionally reassured by the quantity of Zadeh’s gross sales. “He was doing between $5-6 million a month which was fairly a powerful enterprise,” he shared in an interview with Good Kicks.

However in 2019, the connection between Zadeh and Ponte took a distinct flip. “The preliminary pink flag was that he was promoting footwear to my son, and there was a problem with supply. I don’t assume he knew that my son ordered footwear from him, however there was an order for $10,000 or $12,000 and he was giving my son the runaround. No approach would I think about that this is able to be a foreshadow for what would occur years later.”

“The ultimate straw got here when Michael was disrespectful to my workers,” stated Ponte. “Initially issues have been okay, however he began to get fairly boastful, and abruptly Michael needed to dictate the phrases we have been going to simply accept and, nicely, we didn’t settle for them or his enterprise.”

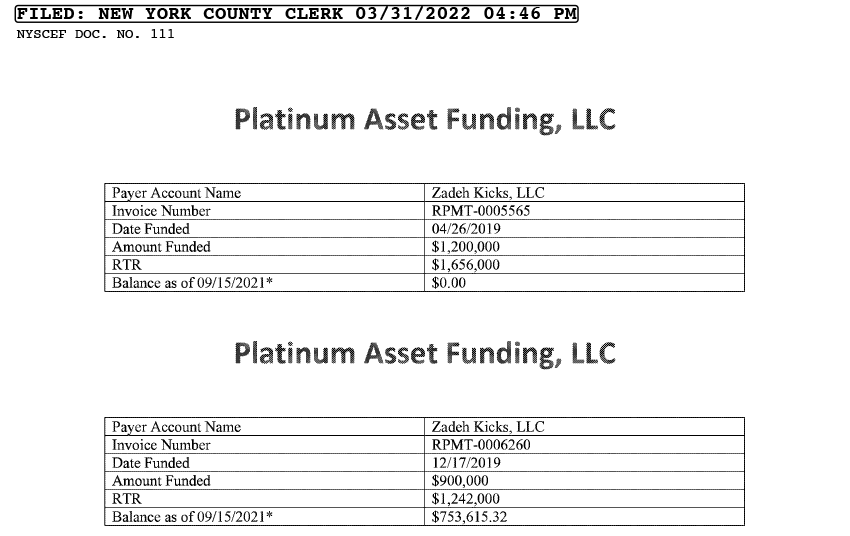

In accordance with a UCC file search from the Oregon Secretary of State, Zadeh obtained further loans earlier than and after his relationship with Ponte ended. The primary loans registered with the Oregon Secretary of State have been filed in February of 2018 and at this present time, there are seven lively loans for Zadeh Kicks. The mortgage quantities and cost phrases are usually not publicly obtainable, however Good Kicks obtained paperwork of loans that Zadeh Kicks secured in 2019 with Platinum Asset Funding, LLC, one other enterprise mortgage supplier based mostly in New York.

In addition to their voluntary dissolution, there aren’t any recognized authorized proceedings that Zadeh Kicks or its proprietor Michael Malekzadeh are a celebration to, however paperwork detailing a few of their loans have been hooked up to an unrelated lawsuit in New York County between Chatham Capital Administration and Platinum Asset Funding.

In accordance with these paperwork, Zadeh Kicks obtained a mortgage from Platinum Asset Funding in April of 2019 for $1.2 Million, with a payback quantity of $1.656 Million, to be paid in 52 weekly funds of $31,846.15. Earlier than repaying the mortgage with Platinum Asset Funding, Zadeh Kicks borrowed an extra $900,000 with a payback of $1,242,000, in 52 weekly funds of $23,884.62. The efficient APR of each loans is 38%.

In March 2020, Zadeh Kicks’ weekly funds of $55,730.77 for the 2 loans have been diminished to $6,000 in what seems to be an adjustment that coincides with the start of the COVID-19 pandemic. In accordance with paperwork filed with the New York County Clerk as of September 15, 2021, Zadeh Kicks owed $753,615.32 on the second mortgage.

Whereas it’s not utterly clear what occurred in April of 2022, it seems that Zadeh Kicks’ run was quickly coming to an finish. The web site disappeared with none warning for a few days constructing angst amongst these ready on orders and unanswered emails. However issues appeared to have been greater than technical when Michael Malekzadeh referred to as Tim Waldbridge–the proprietor of 503 Motors.

“Michael stated one thing about having a big chargeback and needing cash to cowl what was owed. He had a automobile on the store that he talked about was simply bought to Chicago and be looking out for a shipper.”

All of sudden in a single transaction, Michael Malekzadeh bought a number of autos in his assortment to Chicago Motor Cars. Whereas it’s not sure what Michael was paid for the autos, 4 of the automobiles he used to personal are on the market for a complete of $3,049,200.

After 9 years of enterprise, on April 29, 2022, Zadeh Kicks stopped accepting funds.

THE CASUALTIES OF ZADEH KICKS

Zadeh Kicks’ dissolution left lots of—maybe hundreds—of sneaker collectors and resellers financially devastated. In researching this story, Good Kicks spoke on to 17 clients of Zadeh Kicks, with undelivered orders starting from $3100 to greater than $3 million. Resulting from probably pending litigation, some agreed to talk on the file, underneath the situation that their names wouldn’t be revealed.

A twenty-three-year-old buyer of Zadeh Kicks began mowing lawns at 9 years of age, refereeing youth basketball video games as a teen, and acquired and bought footwear whereas going to varsity. Professionally he works as an account govt at a Salt Lake Metropolis-based tech agency however has been repeatedly upset in makes an attempt to afford a down cost in a aggressive housing market swarming with out-of-state money patrons. So he determined to take each greenback he saved and put it to work, by doing what had at all times given him the very best return for his buck: inserting a pre-order for sneakers with Zadeh Kicks.

A thirty-one-year-old buyer of Zadeh Kicks from upstate New York remembers wanting the “Chicago” Air Jordan 1 since lacking the discharge in 2015 and positioned his first order with Zadeh Kicks for the footwear in 2019 together with just a few different pairs shortly after that he bought to native sneaker resale retailers. After seeing repeated success over a few years the contractor and property investor joined together with his good friend to take a position extra with pre-orders of sneakers with Zadeh Kicks, promoting a mixed three homes to give you $751,000 in undelivered items.

A twenty-four-year-old buyer of Zadeh Kicks from Southern California had three profitable experiences of inserting pre-orders when just a few of his mates needed to pool their cash collectively together with his to put an order for greater than $1 million. Regardless of having earlier success working with Zadeh, the order positioned in 2021 for Cool Gray Air Jordan 11s has left them with out footwear and with out solutions.

These collectors, together with hundreds of others, put monumental religion in Zadeh Kicks, a platform that they noticed as progressive and distinctive, with an related group of sneakerheads who shared their ardour. What they didn’t see, for probably the most half, was the big threat they have been taking over.

THE BLAME

It’s straightforward to put the blame for this disaster totally on the shoulders of Michael Malekzadeh. He was, in any case, roughly the only real driving drive behind Zadeh Kicks, and displayed loads of behaviors typically related to monetary predators.

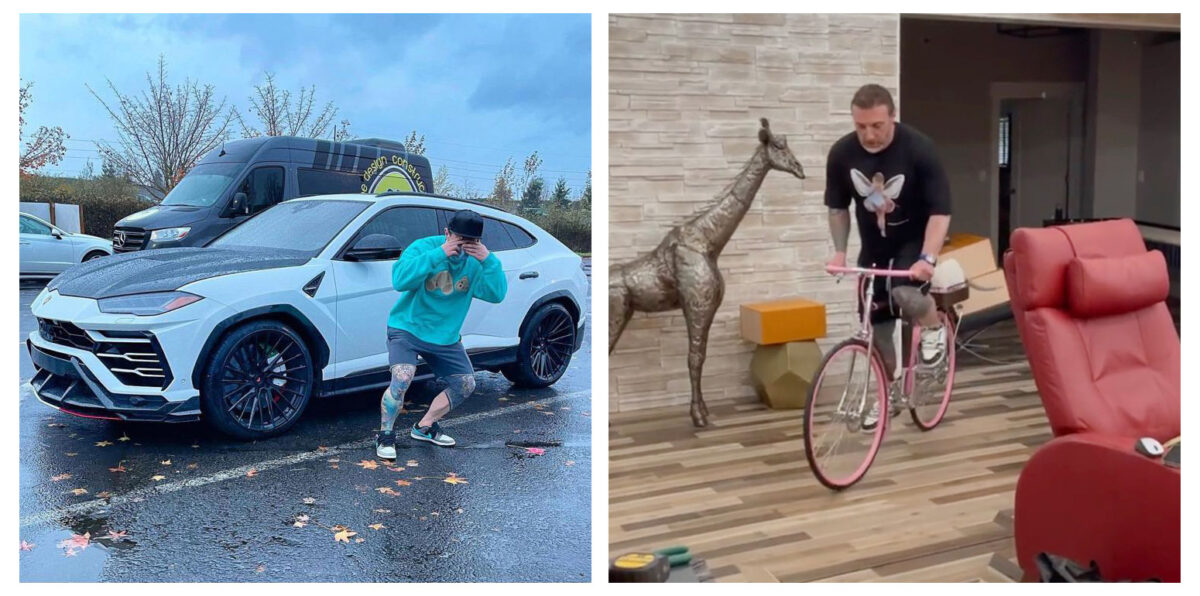

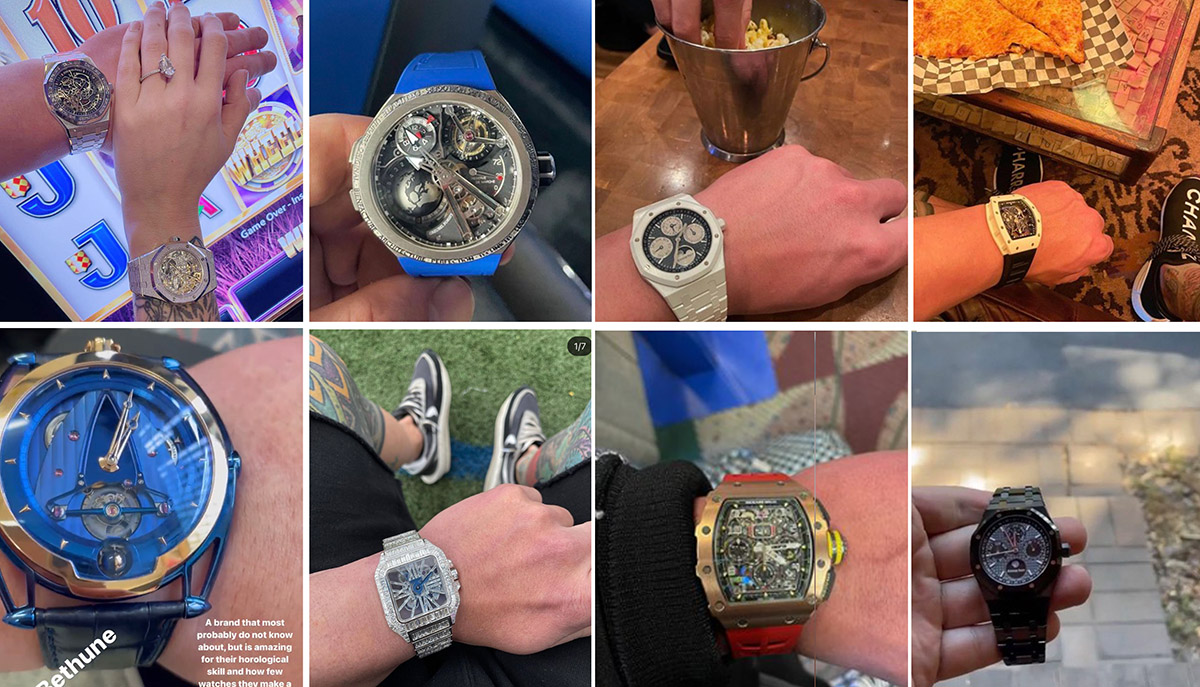

His penchant for quick, costly automobiles was at all times on full show, with photographs ceaselessly popping up on social media of Malekzadeh in entrance of his Lamborghini Aventador SVJ 63, McLaren 765LT, Rolls Royce Cullinan, or one other of his 10+ high-end rides. His on-line communication alternated between bombastic and elusive, highlighting large gross sales numbers whereas providing countless excuses for cargo and cost delays, altering insurance policies with no rationalization, and making obscure guarantees of future enhancements. For collectors who engaged closely within the Zadeh Kicks market, he was additionally an intimidating presence, overtly threatening to ban and block anybody looking for a refund.

But it surely’s not as if these behaviors are distinctive, and even all that uncommon. The world is filled with self-serving, smooth-talking gamers on the lookout for an angle, however most are constrained by rules and oversight, particularly the place giant sums of cash are concerned. For those who consider different secondary markets the place some huge cash adjustments fingers—automobiles, artwork, property, and so on.—they’re all tightly regulated, with clear procedures for how one can conduct transactions and file complaints, and enforcement entities with actual enamel.

The secondary client items market is totally different. Shopping for and promoting lots of of hundreds of {dollars} price of sneaker pre-orders is carried out, mainly, the identical approach as shopping for a single pair for $80 from a good friend: with no client protections, no reporting necessities, and no monetary reserves. This may be like shopping for a home with no requirement for inspections, no title insurance coverage, and no escrow.

Client items lack this sort of oversight as a result of, up till just lately, it wasn’t mandatory. Shopping for a product on the secondary market normally meant buying a costume at a consignment store, or ordering a used projector on ebay, so there was a restrict on how a lot cash was concerned, and sometimes a 3rd occasion that arrange its personal insurance policies to guard patrons and sellers.

The secondary sneaker market, although, has change into an enormous enterprise, with bulk orders reaching hundreds of thousands of {dollars}, and—particularly within the case of Zadeh Kicks—a thriving pre-order market, with such lengthy lead instances and excessive volumes that it primarily turned an unregulated futures market.

Zadeh Kicks’ pre-orders are removed from the primary and gained’t be the final that trigger monetary hurt to customers. The State of California sued Kanye West’s Yeezy brand underneath client safety legal guidelines on the books relating to transport instances. Would possibly or not it’s time that comparable legal guidelines are drafted relating to pre-order gross sales too?

The 2 largest sneaker resale platforms, GOAT and StockX have a mixed market valuation of $7.5 Billion following their most up-to-date rounds of fundraising final yr and with the continued hints at a StockX IPO on the (precise) inventory market, it’s lengthy overdue for policymakers to have a deeper have a look at how present our client safety legal guidelines are that govern the area.

Michael Malekzadeh could possibly be seen to some as a con artist, however he was additionally could possibly be seen as a sneaker fanatic who bought in over his head and realized too late that there was no lifeboat to seize onto.

A few of this slack was finally taken up by bank card firms, who did an admirable job of serving to clients recoup their losses. Quite a few people who had conversations with representatives from American Categorical, interviewed for this story, have been instructed that Zadeh Kicks’ dissolution resulted in one of many largest chargeback volumes they’d ever processed for a single vendor. The catch, nonetheless, is that chargeback protections are normally restricted to 180 days from the date of buy—longer than the lead instances on many scorching sneaker pre-orders.

Experiences from clients relating to their experiences with PayPal haven’t been as constructive. Whereas initially it appeared that PayPal was making customer support a precedence for patrons of Zadeh Kicks, information broke final night time, June 14th, that quite a few individuals who filed claims on PayPal obtained discover that their accounts had been frozen till additional discover.

What’s unclear at this second is to what extent the platforms Shopify–the platform Malekzadeh used for the enterprise to interface with the general public, PayPal–a cost middleman was used to simply accept hundreds of thousands of {dollars} in funds, and Chase–the financial institution that Zadeh Kicks used for firm banking, missed of their critiques and audits of a enterprise of this measurement utilizing their platforms.

What measures needs to be in place that guarantee retailer credit score is backed up by a sure stage of liquidity for the service provider? As we write and rewrite legal guidelines about cost new cost strategies for a altering digital panorama, how can now we have higher insurance policies that make the “good as money” retailer credit score precisely as described?

If there’s a lesson to remove from all this, it’s that until somebody begins regulating the secondary client items market, Zadeh Kicks is only the start. As with so many digitally-enabled providers, the shopping for and promoting of futures in client items has expanded quicker than legal guidelines and insurance policies can successfully regulate it. A platform like Zadeh Kicks wouldn’t even have been potential within the early 2000s, however now it’s virtually trivially straightforward to arrange utilizing current instruments and platforms.

Sneakers are on the forefront of a brand new type of funding, and it has a strong cautionary story in Zadeh Kicks. The query is, will different funding communities be taught from it?

Michael Malekzadeh is represented by David Angeli and the Angeli Regulation Group. In the midst of our investigation, we spoke together with his illustration and obtained this official assertion beneath.

Out of respect for the FBI’s ongoing investigation, it will not be applicable for Michael Malekzadeh to remark at the moment on the specifics of what’s a really difficult state of affairs. Nevertheless, he’s 100% dedicated to doing all the things he can to reduce the fallout on anybody who could have been negatively impacted.

As beforehand reported, in accordance with an electronic mail despatched out from the receiver, he’s working with the federal authorities in a prison investigation relating to Zadeh Kicks.

Anybody who believes they’re a sufferer can name the FBI at 1-800-CALL-FBI.

Michael Malekzadeh has not been charged with any crime at the moment.

The FBI has posted a type for looking for sufferer data at fbi.gov. When you’ve got carried out enterprise with Zadeh Kicks and are owed both cash or footwear you possibly can present your data to the authorities on the hyperlink above.

July 29, 2022: Zadeh Kicks Founder Michael Malekzadeh and CFO Bethany Mockerman have been indicted for wire fraud, conspiracy to commit financial institution fraud, and cash laundering. (justice.gov)

August 3, 2022: Michael Malekzadeh and Bethany Mockerman plead not responsible to prices of wire fraud, conspiracy to commit financial institution fraud, and cash laundering.

December 16, 2022: Zadeh Kicks stock is being liquidated on ebay.

March 20, 2025: Michael Malekzadeh and Bethany Mockerman plead responsible to Wire Fraud and Conspiracy to Commit Financial institution Fraud

March 21, 2025: Good Kicks receives unique assertion from Malekzadeh’s attorneys following his responsible plea

Over the previous three years, Michael Malekzadeh has carried out all the things in his energy to simply accept duty for his wrongdoing and make issues proper with the individuals who trusted him.

In early 2022, Mr. Malekzadeh took the extraordinary step of turning himself in to the FBI earlier than any investigation had even begun.

To maximise the victims’ restoration, he had hundreds of thousands of {dollars}’ price of things and money delivered to the federal authorities. And he voluntarily filed for a civil receivership for his firm, Zadeh Kicks, to ensure the corporate’s property have been preserved and pretty distributed to victims. Mr. Malekzadeh totally funded the receivership and supplied extraordinary cooperation to the receiver over the previous 3 years, leading to victims and collectors recovering hundreds of thousands of {dollars}.

Yesterday’s responsible plea was the newest step in Mr. Malekzadeh’s three-year, single-minded mission to make amends for what he did unsuitable. Even after his prison sentence is imposed, Mr. Malekzadeh will proceed that effort.

Revision historical past:

June 15, 2022: preliminary publication

June 15, 2022: typo correction

June 19, 2022: typeface format change

July 29, 2022: Zadeh Kicks’ Malekzadeh + Mockerman Indicted for Wire Fraud, Conspiracy to Commit Financial institution Fraud, and Cash Laundering

August 3, 2022: Zadeh Kicks Proprietor + CFO Plead Not Responsible to Felony Costs

August 19, 2022: added hyperlink to FBI.gov type In search of Sufferer Info

December 16, 2022: Zadeh Kicks stock is being liquidated by the Receiver on ebay

April 16, 2024: Up to date useless hyperlinks to archived pages

March 20, 2025: Zadeh Kicks’ Founder, Accomplice Plead Responsible to Wire Fraud & Conspiracy

March 21, 2025: EXCLUSIVE: Attorneys for Michael Malekzadeh Launch Assertion Following Responsible Plea